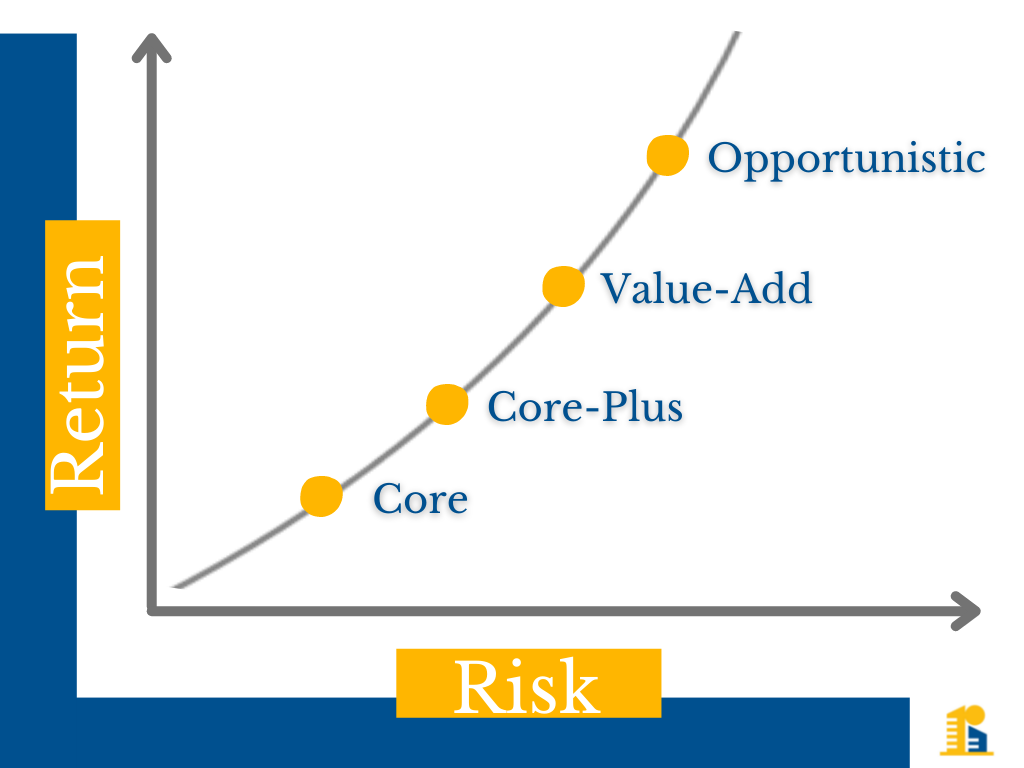

A relationship exists between return and the corresponding risk required to achieve that return. While we know there are various asset types that investors may choose to participate in within commercial real estate (e.g. multifamily, self-storage, office, retail, industrial, etc.), there are also 4 primary asset strategies that investors can choose from – Core, Core Plus, Value-Add, and Opportunistic.

The graphic above demonstrates what is probably already obvious; you can target achieving higher returns but those higher returns come with more risk. As with all investments, it's critical that you understand what you are investing in and plan your allocation accordingly in alignment with your investment goals & objectives (capital growth, cash flow / passive income, preservation, etc.).

I will discuss the 4 different asset strategies in greater detail below.

Core

Core assets carry the least risk and typically deliver returns in the 6-9% range. With core assets you’re beating inflation and getting a steady stream of income but the prospect of obtaining outsized returns in the double-digit range is unlikely. However, this asset strategy is extremely safe and can create a strong foundation for any portfolio. There is low to no leverage for this strategy which translates to negligible foreclosure risk and performance that is largely unaffected by business and economic cycles. Examples of core assets include newly constructed, Class A properties in major economic and metropolitan hubs.

Core Plus

Core plus assets have a low to moderate risk profile with the utilization of more leverage and the pursuit of moderate capital appreciation. Returns in this strategy tend to be in the 9-14% range and leverage can typically range from 50-65% LTV. Core plus assets are similar to core assets in profile but may introduce additional risk factors such as building age, condition, or a location less optimal than central business districts with desirable amenities nearby. Minor property improvements or obtaining operational and management efficiencies allows for potential achievement of greater return.

Value-add

Value-add assets are further along the risk-return curve. They are best described as moderate to high risk but present the opportunity to deliver returns in the 15-20% range. Leverage also starts to tick up within this strategy and can span 65%-85% LTV. These assets are typically underutilized, mismanaged, or present an opportunity for a turnaround or repositioning effort to get the asset performing again. Think of an apartment with high vacancy or rents significantly below market rents that has a high loss to lease figure. Also, think of apartments that could be 70’s-80’s-90’s vintage with classic interiors that could use an upgrade to more modern finishes, black or stainless steel appliances, and better flooring such as luxury vinyl plank or wood.

Opportunistic

The opportunistic strategy presents the most potential return but also carries the highest risk. These can be extreme turnaround situations where there is major vacancy, structural issues, or financial problems. Also sometimes referred to as distressed assets, there can be additional complexities introduced such as foreclosure, code violations, liens, or pending litigation. Special expertise or experience can sometimes be helpful in realizing the value-add strategy required for these projects. With the higher risk, returns can clear the 20% mark with this investment strategy.

Final Takeaway

Once again, it’s vitally important that you understand the relationship between risk and return amongst various investment strategies. When seeking certain return expectations, knowing your risk appetite will help with planning and help manage levers that can mitigate against risk for better risk-adjusted returns. Appropriately selecting the right amount of leverage or honing in on investment criteria around vintage, location, or financial condition can best tailor your strategy to meet your desired objectives.

To learn more or hear updates from us, you may like and follow us on our social media accounts.